EXCLUSIVE: The government will need to stump up nearly £800m a year to offset the worst effects of state pension poverty.

Rachel Reeves talks pension funds in Mansion House speech

Rachel Reeves is set to rake in an extra £6billion if she increases the state pension age.

A report published by the Institute for Fiscal Studies (IFS) and pension provider abrdn said hiking the state pension agefrom 66 to 67 between 2026 and 2028 will save government £6bn a year.

The rise has been brought in by successive governments and is based on a predicted increase in life expectancy.

But the IFS report found while poverty rates among the over 65s are lower than for the working-age population, there were groups of pensioners as well as those reaching retirement where poverty rates are relatively high.

These groups included pensioners who were privately renting; this is a trend set to contineu as only four per cent of those born in the 1940s were private renters in their mid 50s, compared with 10 per cent of those born in the 1960s.

READ MORE WASPI women may hear DWP compensation update soon as Labour faces growing calls

Our community members are treated to special offers, promotions, and adverts from us and our partners. You can check out at any time. Read our Privacy Policy

The report has been published today as part of a joint project between the IFS and abrdn. It outlines two ways in which targeted additional state support could help support those who would be plunged into poverty by the state pension age increase.

The IFS said cost of each of these measures would be a fraction of the savings to the exchequer from increasing the state pension age.

The first measure includes providing extra support to those who were a year below state pension age and on universal credit.

If the government introduced the measure it would reduce poverty in around 30,000 households.

The annual cost of this policy would be around £600 million, or a tenth of the exchequer gain coming from a one-year rise in the state pension age.

The second would be to give increased support only to those receiving both universal credit and health- related benefits. Such a move would cost around £200 million per year but would only help reduce poverty in 3,000 households.

Don’t miss…

DWP update to pensioners owed up to £12k in back payments [REPORT]

State pensioners going to Australia will miss out on £470 payment [LATEST]

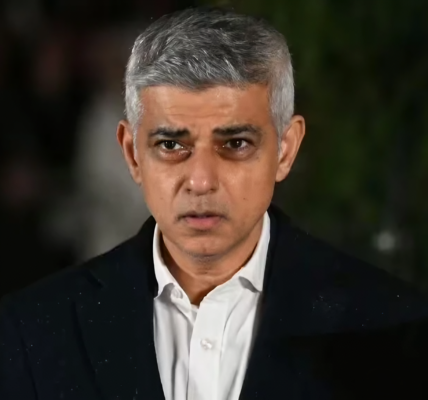

Rachel Reeves is set to make a £6bn saving (Image: Getty)

Further support for those on low incomes would reduce poverty levels more but the IFS said there were more cost implications and potential negative effects on employment.

The IFS said it was particularly concerned about the growing number of pensioners who rent, rather than own their own home.

Allowing pensioners to claim housing benefit for an additional room could help lift single pensioners and pensioner couples out of poverty by making them eligible for support based on rents for two-bedroom homes in their local area.

The IFS said pensioners often spend a lot of time at home, and it would allow them to have children or grandchildren over to stay in a room of their own. The cost of this support would come to around £150m a year.

Sebrina McCullough, director of external relations at Money Wellness, said the report highlighted a gap in support for those approaching retirement.

“As the state pension age increases, people are required to wait longer before receiving additional support. A third of people supported by Money Wellness, who are within five years of retirement, report having a physical disability or illness that directly affects their income and costs.

She said: “On average, these individuals are living with a monthly budget deficit of over £100. The IFS is right to advocate for earlier transitional support for those approaching state pension age.

“Additionally, it’s important to note that billions of pounds go unclaimed each year due to the complexity of the benefits system, which makes it difficult for people to navigate. More proactive support is needed to help ensure individuals are claiming all the benefits to which they are entitled.”

Most Popular Comments